Enjoy the flexibility and convenience.

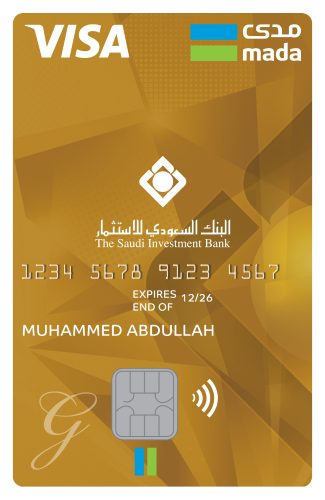

mada Gold Debit Card

Cash is your past… your mada Gold Debit Card from The Saudi Investment Bank is the future.

Your mada Gold Debit Card from The Saudi Investment Bank is one of the best choices for accountholders to satisfy their financial needs and perform their daily transactions in a smooth yet secure manner. Enjoy greater security with the latest Chip-and-PIN technology, allowing you to use your card safely at millions of retail outlets and ATMs worldwide.

Globally Accepted

Using your card at more than 30 million merchants worldwide.

US Dollar Cash Withdrawal

You can withdraw US Dollars at selected SAIB ATMs.

Without having to visit the branch and wait in long queues.

Increased PoS Purchase Limit

You can extend your daily purchasing limit through PoS.

From 20,000 to 200,000 to suit your lifestyle and needs through E-banking.

Apple Pay

Apple Pay provides SAIB cardholders a convenient, secure and a new way to pay for purchases.

Through IOS-based devices by simply adding their cards via “Flexx Touch” or Wallet application inside and outside the Kingdom.

Customer service around the clock

Flexx Call team is available around to clock to serve you.

Flexx Call team is available around to clock to serve you. Simply, call 800 124 8000 (if within the Kingdom), or +966 11 418 3100 (if overseas)

Online Payment

SAIB mada Debit Cardholder may shop and pay online easily and securely using the card with the “Verified by Visa” service.

You can avail of “Aseel” program discounts at prestigious merchants from dining to shopping, travel to entertainment and much more. For details, please click here.

| Average Balance | 100,000 for 3 months. |

| Instant Deposit | 500,000 to less than 1,000,000 for new customers. |

| Salary | 25,000 to less than 40,000 for 3 months. |

*only applies for the current account (Saving account other type of account does not apply).

- Customer must have a Gold segment account.

- Minimum age of 18.

- Signed account opening form.

- For Expatriates : valid ID and passport.

To view the risks of Debit Cards “mada”, click here

| Service | Fees |

|---|---|

| New mada card issuance | Free |

| mada card renewal | Free |

| mada card reissuance | 30 |

| mada supplementary card | 30 |

| Reissuing PIN for mada card | 15 |

| International cash withdrawal | 25 + 2.75% currency exchange rate |

| Balance inquiry GCC net | 3 |

| Cash withdrawal in GCC net | 10 |

| Balance inquiry out of the Kingdom | 3.5 |

| POS purchase out of the Kingdom | 2.75 % for currency exchange rate |

mada Gold Debit Card from The Saudi Investment Bank is a card issued for the Gold segment accountholders which allows instant access to funds available in the account, saving you the need to withdraw cash. Your card will help you manage your finances and monitor your spending, as all transactions made with your card will appear on your bank account statement.

Visit the nearest SAIB branch if you meet the Gold segment criteria.

A mada debit card is a "buy now, pay now" option, while a credit card is a "buy now, pay later” option. Therefore, when you use your mada Gold Debit Card from The Saudi Investment Bank, there will be no monthly repayments, and hence, no profit rate will be charged.

You should activate your mada Gold Debit Card and generate your card PIN before first use. After successful activation, you are ready to start using your card at supermarkets, restaurants and other establishments around the world.

- View account balances

- View transactions history/statement

- View your card accounts details and transaction histor

- Transfers between your accounts and other SAIB accounts

- SARIE transfers within the Kingdom of Saudi Arabia

- Make transfers to your investment account with Alistithmar Capital

- Make international transfers

- SADAD utility payment

- MOI government paymen

- View all payments history

- View WooW rewards and redemption

There are many more services provided. For more information, please click here.

You can view your PIN easily through Flexx Click, Flexx Touch or Flexx Call.

In case of loss or theft of your card, immediately call 800 124 8000 (if within the Kingdom), or +966 11 418 3100 (if overseas) to block your card and request a replacement card to be sent to you within 5-7 business days, You may also request for an instant issuance by visiting the nearest SAIB branch and your card will be inactive until you activate it again.

You can view your PIN from Flexx Click, Flexx Touch or through Flexx Call.